Zambia’s leading full-service, tailormade banking available to all

Stanbic Bank’s comprehensive offer of financial services, strong capital assets, sector expertise and widespread regional presence has actively contributed to their outstanding success and to Zambia’s growth.

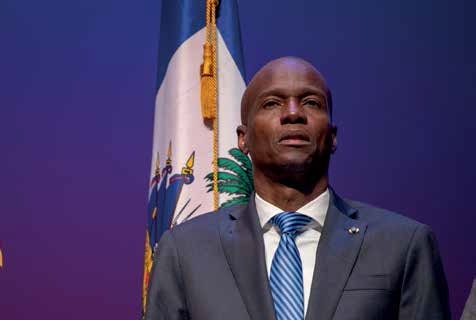

From the youthful (up-coming) individual to the largest corporation, Stanbic Bank Zambia offers everyone an opportunity to grow. With the largest capital base in the market, 28 branches, 99 ATM’s and a strong digital agenda, they are uniquely placed to provide financial services to a wide range of customers in the country’s key economic sectors. “Our number one priority is looking out for our clients and stakeholders. We do everything in our power to make sure our service delivery is second to none. We provide solutions that are appropriate to Clients throughout their client journey or business cycles, that evolve with them, and by helping them grow. By doing this they and indeed Zambia grows as well”, assures Mr. Mwindwa Siakalima, CEO of Stanbic Bank Zambia.

To keep moving forward, they know digital transformation is key; particularly in a country where financial inclusion reaches only 69%, but there is great potential to develop it as 53% of the population is below 18 years-old and tech-savvy. Therefore, their strategy is to promote digital financial inclusion by targeting both young and old, low-income and high-end customers, through USSD and digital banking. “Our intention is to grow the bank using technology, so we have to make sure there are lots of different self-services available to our customers so that they can do things on their own. If there is need for technology, our tech products are up and running, safely and available at all times; however, if there is need for a human being we are also there”, explains Mr. Siakalima, adding that by embracing this customized digital agenda they expect to expand their financial inclusion goals further. Another strategic element driving Stanbic Bank’s growth and success is its unique combination of local sector expertise and international connections. On the one hand, they have teams of experts working in the country’s most relevant industry sectors, with a strong track-record of financing projects in mining and metals; power and infrastructure; oil, gas and renewable energies; agribusiness; telecommunications; media and financial institutions. On the other hand, being part of Standard Bank Group, a financial and banking institution born in South Africa over 160 years ago and currently operating in 20 Sub-Saharan countries, they have privileged access to a wide network of in-country advisors and international representatives as well. Like Mr. Siakalima says, “we have different units of sector experts with deep local knowledge who also have international contacts. For investors, it is an advantage to deal with a bank that is so locally rooted and well represented across the African continent.”

Furthermore, Stanbic Bank is committed to driving sustainable growth by supporting financial inclusion and literacy efforts particularly focused on women and younger generations. Thanks to a $15 million dollar investment of the International Financial Corporation, a member of the World Bank Group, they have been able to support capacity-building programs like their Anakazi Banking, directed at helping female entrepreneurs acquire all the tools and funds necessary to run their own businesses; as well as scholarships and mentorship for underprivileged boys and girls given in partnership with the Kucetekela Foundation.

Given all these inclusive initiatives and strategic assets, there is no wonder why Stanbic Bank is one of Zambia’s most trusted financial institutions. After all, like Mr. Siakalima highlights, “as a bank we have literally configured ourselves to meet our specific client’s needs.”