Generali Philippines: a Lifetime Partner for life & health for everyone in the country

With an ambitious strategy the insurance giant is making headway in the country.

With US680 billion in assets, 82,000 employees world-wide, and headquartered in Trieste, Generali is the largest insurance company in Italy, and one of the oldest world-wide providers. Present in 50 countries, Generali began its operations in Asia in 1975 and is now present in 8 Asia countries, including China and India. The company entered the Philippines in 1999 through a joint venture with a local partner, as part of its strategy of expansion into Asia. In 2016 it went solo, and Generali Phillipines is now the leading insurance provider in the country focusing on group life & medical, employee benefits and coverage.

With vast experience of more than 25 years of working across Asia markets, and his prior role in Generali Asia Regional Office as the Regional Head of Health, Dr. Hak Hong Soo, ingaporean, is the capable leader for heading the Philippine office and to take it to the next stage. “The Philippine market is one of the most dynamic in the region”, explains CEO Dr. Soo: “Population is high, GDP growth is good, and insurance penetration rates are low, so it is a place we can grow”.

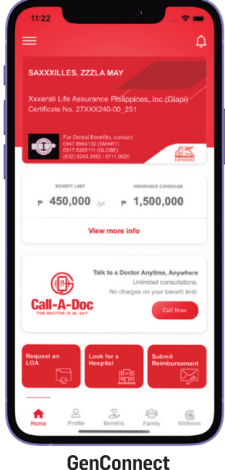

So far, the focus of the Company has been placed on group portfolios in the life and medical space, dealing with group medicals, employee benefits and credit life insurance through financial institutions. In addition to customized product offerings, Generali Philippines provides value added services such as telemedicine, wellness program, digital platforms or customers, HR partners, and network hospitals/clinics/doctors. It has a nationwide network of more than 1800 accredited hospitals and clinics and over 30,000 partner doctors. “This is what sets us apart, what allows us to take care of our customers not only during the claims protection but also throughout their healthcare journey”, explains Dr. Hak Hong Soo. With a protection gap of US480 million, there is ample room for private product designs that fit the needs of a growing middle class looking for sustainable solutions. Dr. Soo was trusted to lead the company to continue growing profitably in its group business, as well as expanding into retail insurance in the country. “We want to be the lifetime partner of our customers, and make sure they get the care they expect. Our promises to customers are to provide them a seamless and caring xperience, personalised value proposition, and phygital advisory support”, he explains. To this purpose they are launching an e-commerce platform to promote retail products through a seamless customer journey experience. “We are still relatively small comparing to other Generali offices in Asia,” Dr. Soo concludes, “but with clear leadership, good management, and strategic support from the Group, I am sure Generali Philippines will grow to better serve our customers as their Lifetime Partner”.